Property Taxes Are Paid To Which Levels Of Government

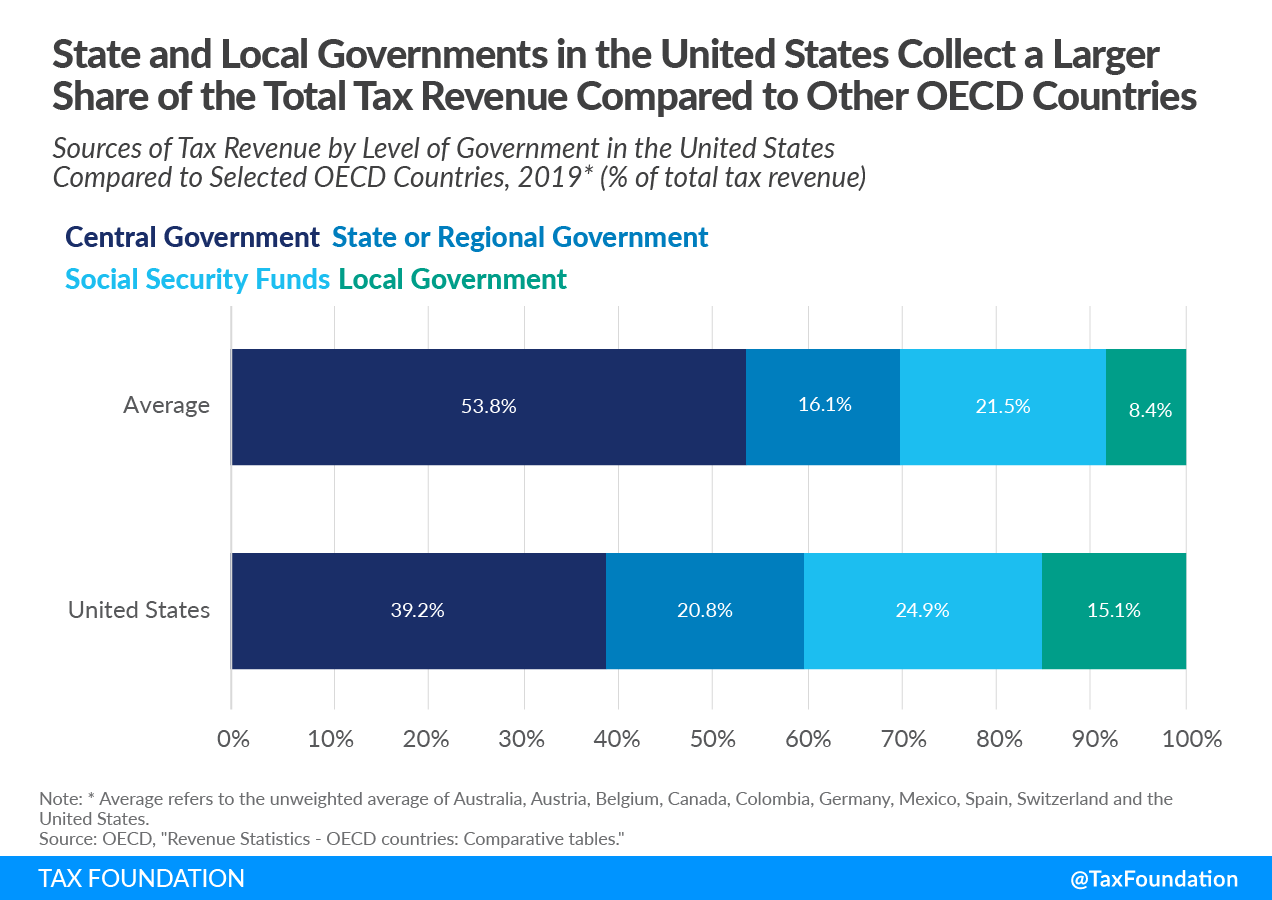

The share of revenue received by each type of local government from the 1 percent rate varies significantly by locality.

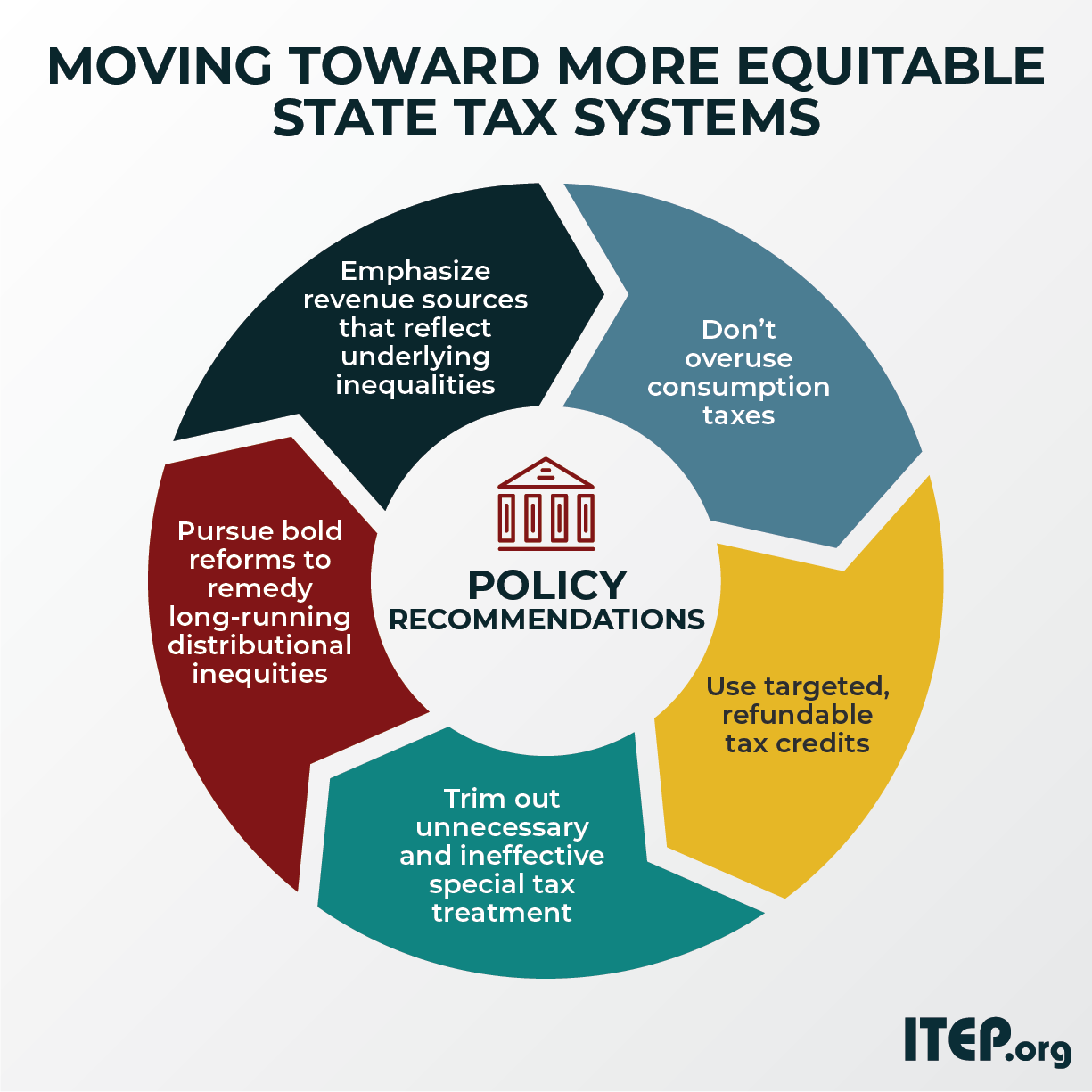

Property taxes are paid to which levels of government. A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. I and iii only D. Property tax is a local tax imposed by local government taxing districts eg school districts municipalities counties and administered by local officials eg township assessors chief county assessment officers local boards of review county collectors.

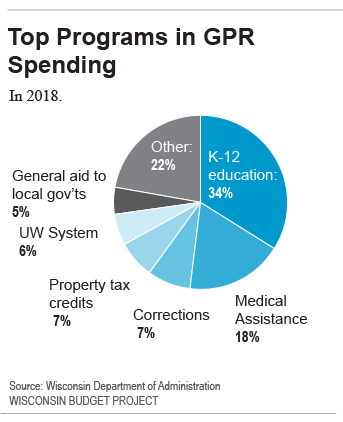

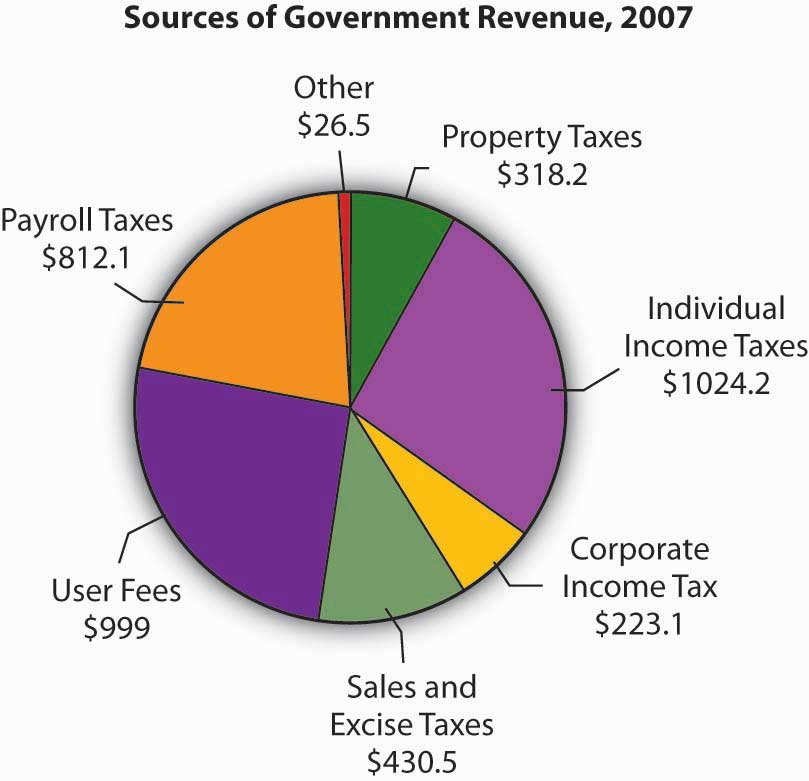

Property taxes are a major source of income for local and state governments and are used to fund services such as education transportation emergency parks recreation and libraries. Taxes paid to the government on your income paid each time you get a paycheck. What is money that people earn.

In this example a small municipality with three properties worth 125000 175000 and 200000 has services costs of 2000 that are paid by property owners through property taxes. Property tax supports many different taxing authorities Cities counties school districts and townships are the most common. Leave a Reply Cancel reply.

Looking only at local governments property taxes provided more three-quarters of own-source general revenue in Connecticut Maine Massachusetts New Hampshire New Jersey and Rhode Island in 2017. Value is arrived at upon application of the assessment levels to the market value of the property. And also the state government of some state has a uniform method of collecting the property tax rather than the different local government jurisdiction collecting different property tax for a particular property.

This rate paid as property tax differs from one local government in a particular state to another. Property owners pay property tax calculated by the local government where the property is located. County Treasurers collect tax revenues and then distribute or allocate the dollars to local authorities.

County governments for example receive as little as 11 percent Orange and as much as 64 percent Alpine of the ad valorem property tax revenue collected within their county. Taxes ReceivableCurrent 500000 Est. Used for federal goods and services.

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)